I recently tried to migrate our company to salesforce.com. Here is a primer on HOW NOT TO SERVICE...

Success with Executive Opinion Interviews

Rules for eliciting qualitative feedback from executive decision makers are different than traditional methods used by market research practitioners. To get the best data and insights, market researchers need specialized methods for attracting, recruiting, interviewing, and eliciting good insights from these important decision makers. Here are seven key principles to guide your next B2B executive decision maker qualitative research project.

- Exclusivity: This pertains to way the project objectives and discussion agenda are framed. Senior executives are not used to being research subjects and are easily turned off by typical consumer pitches and offers to get paid for sharing their opinions. To appeal to this class of respondent, state the objectives of the research in business terms. An awkward issue that is sure to emerge is screening. In the research field, consumers are asked to answer a screening questionnaire to determine if they qualify-a definite deal breaker with executives. Here are some suggestions:

- Position the essential screening process as a way to ensure you are not going to waste their time.

- Avoid the long consumer screeners. Know your prospect beforehand. Have detailed profiles from Linked In and other sources. As a rule, if you need to ask more than four to five questions, you haven't done your homework.

- You do not want to waste their time asking how many employees the company has or what industry they are in-use public sources for that.

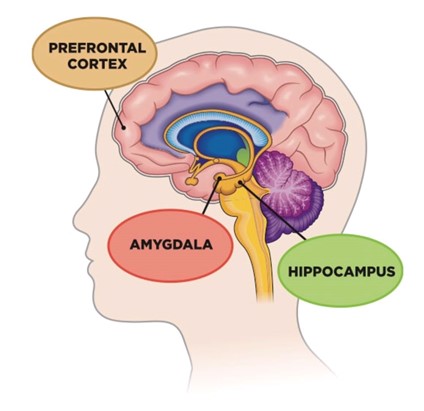

- Conversational style: Executive interviews should be open ended conversations much more than Q&As. Yes, I realize you are trying to put all interview data into a spreadsheet and want to therefore enforce the structure. You are prioritizing data structure over data quality when you do that; it’s called qualitative research for a reason! This results in poor quality data not to mention a turn-off for the respondent who may just pay less attention to the interview and get distracted. Executives have a lot on the plate and on the brain, you don’t want them to become less engaged and bored with your questions, thinking about other priorities, or trying to get a couple of emails out while you fire away with your non-engaging questions. The diagram here summarizes recent thinking on brain power and information processing. There is only so much cognitive processing power we all have available, and the human brain strives to keep as much of this open for important survival activities with the resultant tendency to relegate everything they possibly can to lower brain functions like the Amygdala. And you do not want your interview to end up there.

- Expert moderation: You know we were going to bring this up. Hiring a professional moderator is a must, and one who has moderated with executives. You may impute ulterior motive to us here as we are in the research business. After all, your staff members have been conducting usability lab interviews, why couldn't they be purposed for this? What an independent professional moderator provides is also objectivity in conducting the interview and comfort for the executive in being able to share their opinions about a vendor and their products openly and candidly with an independent third party. And more importantly, you need a moderator with domain experience in your field. If the conversation involves discussing complex technology concepts such as digital transformation, machine learning or AI, the moderator who last week was conducting focus groups for a new coffee product will not cut it. As started above, executive interviews are not Q&As, the moderator needs to be able to do "laddering", i.e. follow up their response with probing questions that may not have been part of the original agenda or interview guide. Without such probing, the insights obtained are likely to not be too valuable.

- Professional recruiting: This is a must. You may be asking-we have lists of customers you say-why can’t we use these? Yes, you can, but in conjunction with your research agency’s external recruiting efforts, so you get a well-rounded representative sample for the following reasons:

- In our experience, these lists are never as good as companies think they are. No offense to those that are tasked within organizations to maintain these, but there are just too many moving parts with customers to stay current on all the dimensions you need to be able to select the right people for your qualitative study. In A/B testing and results tracking, our external recruiting efforts consistently outperform internal lists that clients give us both in terms of accuracy, number of signups and quality of decision maker.

- Customer lists tend to be heavily weighted with those that favor the company. Its natural-those that are close to you and like you are most likely to be ones whose records on your database are most accurate and most up to date. Therefore, those are the individuals most likely to filter into your study. The sample is therefore biased, and you wind up with a rosier picture in your data set than reality!

- Privacy/Anonymity: An important consideration for all audiences these days, privacy is particularly important for executive interviews, especially those from publicly traded companies. Here are some ground rules:

- Ensure them (and do!) that you will report what they share anonymously to the client and their identity will not be revealed, allowing them to be candid about their thoughts. Executives are tasked with being relationship builders for their respective organizations and will often prioritize saying what they need to say to preserve the relationship with your company or client over the candor you are requesting from them unless they are comfortable that their comments will not directly be attributable to them.

- Ensure them (and do!)-that no part of what they are sharing with you will be shared in social media in any way

- Ensure them (and do) that no sales follow up will occur as a result of them participating in this conversation

- No "sneaky peaks" or tricks, as in client sitting in on the conference. We get this request from time to time, most likely because consumer focus groups have clients observing behind the glass. It changes the dynamic of the conversation radically and interferes with the moderator being able to obtain the best insights possible for you. As to wanting to sit in to ensure the questions are working well and your moderator is adept at asking them:

- If you are unable to nail your discussion guide prior to the start of data collection, you are unclear about your business objectives, go back to square one

- If you are not sure about your moderator's ability to conduct the conversation, you have hired the wrong research firm! Establish what you need when making the vendor selection for your important project

- Venue: This is an equally important consideration to the ones mentioned above, especially now in the age of Covid. If you are truly wanting to hear from high level decision makers, please ask yourself the following:

- Do you believe a high level, highly compensated busy executive will take precious time away from family to drive to your focus group facility in rush hour traffic to be given a deli-tray sandwich and a check at the end of a two-hour session for their time? If you are able to get them to come, you may be interviewing the wrong people.

- Do you believe they will be comfortable sharing their views candidly with a group of 8-10 strangers, some of whom may be competitors? Think again.

- Executive opinion interviews belong to the comfort and privacy of the respondent's own surroundings and in the age of Covid, a Zoom call is best.

- If it must be a group interview if you are trying to generate brainstorming or ideation, consider these points:

- The high-level executive may not be your best candidate for this type of discussion

- If they are, two important tweaks to the traditional focus group are needed:

- Conduct the sessions during normal office hours and serve a professionally catered breakfast or lunch

- Consider conducted the session at a venue other than a focus group facility, such as a well reputed local hotel or private club. Pre-covid, we have used all of the above venues, and expect to do so again in the near future.

- Incentives: Lastly, let’s address the tricky subject of incentives and rewards for their participation. Executive decision makers are not too motivated by these and the tendency these days of many research firms and focus group facilities to offer out-sized cash incentives can often backfire when reaching these hard to recruit individuals.

- No amount of compensation can adequately make up for their time, so disabuse yourself of the notion that you will motivate them to attend with your generous incentives as you could with consumers. Avoid the temptation to look up their salary range online and figure out their hourly rate. A recent quote we received from a focus group facility specified a $500 incentive! Needless to say, we did not select them for our project. We have too often seen lower-level managers claim executive decision-making power in an effort to "game" the screener in order to receive the generous incentive. If you are expecting your monetary reward to entice executives to participate, you are on the wrong track.

- The subject matter must be truly engaging and must be presented to the prospective respondent in a compelling manner. Here again, the domain industry expertise of your research provider comes into play. Can they manage to attract the right executive respondents by how they frame to interview topic versus relying on the financial reward. Again, we can’t stress enough the importance of your research provider having domain industry experience in your field.

- Lastly, many executives, especially in publicly traded firms, will not be able to accept any financial compensation due to regulation. Be prepared to make a donation to charity on their behalf. We often get requests to donate to the United Way, Red Cross, even their high school back in Montana recently!

In conclusion, and as an anchor to the above guidelines, evoke the real estate principle of "highest and best use", that a real estate parcel is to be appraised not based on its current use, but the highest use that can be achieved. Which of the two images below do you want your next research project to represent?

![]()

![]()