Extracting Actionable Knowledge From Raw Data

At Silicon Valley Research Group, we employ custom leading edge technology and proprietary analysis techniques to provide the critical insights and strategic recommendations that give our clients a genuine competitive advantage for success in today’s challenging environment. We are dedicated to giving your company the information you need to get the results you want.

This page provides a sampling of our data collection and analytical techniques, however, we are well versed in all market research methodologies and we will use whatever tools will best suit your needs. Please contact us if you have any questions.

Data Collection

Data Collection

Ethnographic Site Visits

Ethnographic Site Visits

Ethnographic site visits involve researchers observing participants in their own environments. An interviewer accompanies a consenting respondent as they utilize and/or shop for a product or service in order to learn what drives customer need and usage. This method can help uncover any un-realized issues or difficulties customers face which can lead to new business opportunities.

Focus Groups

Focus groups are a qualitative research practice in which a group of people that share a common set of characteristics participate in a moderator-led

discussion. At Silicon Valley Research Group, we believe that moderators should have domain expertise on the topic being discussed as this allows for more impactful discussions. We are also proponents of the “unfocus group,” a free-form approach to the focus groups in which we explore more generally who your customers are and their unstated needs. We offer focus groups in a variety of venues:

Focus Group Venues

This is the “classic” technique that people tend to think of when they hear the term “focus group”. A group of select people gather together in a physical location to discuss the topic at hand.

In observational focus groups participants are monitored via on-way mirror or recording. This is particularly effective in analyzing how customers react to and learn to use a product.

Similar visually to a bulletin board, in this technique respondents record their responses to the moderator or other participants in their own time. Responses are not prompted by a direct question or event.

Real time online focus groups are usually conducted via live chat or video conference which can allow for usage of visual aids during a conversation.

Phone focus groups are essentially conference calls. These can be conducted via land-line, mobile, or web-based calling. We are currently beta testing a text message focus group venue.

In-Depth Interviews

In-depth interviews (or IDIs) are a qualitative research technique involving one-on-one conversations with carefully chosen respondents with special knowledge in a relevant area. These conversations probe and elicit detailed answers to questions often using non-directive techniques to uncover hidden motivations. At Silicon Valley Research Group, we believe that interviewers should have domain expertise in the topic being discussed and that interviewees should be selected for quality over quantity. IDIs typically last 30-60 minutes and can be performed in-person, via telephone, or online. Similar to focus groups, online IDIs allow for real time or asynchronous conversations as well as the use of visual aids.

Secret Shopping

![]()

Secret shopping, or "mystery shopping," is where a researcher poses as a regular consumer to shop for a particular product or service. Classically, this practice is used to evaluate customer service or regulatory compliance as well as seek in-depth information on a particular product. With the prevalence of online shopping, secret shopping has also become useful in evaluating user experience and site usability.

Surveys

Surveys are a quantitative research method in which respondents complete expertly composed questionnaires which are then used as a basis for statistical analysis. Micro-surveys such as Net Promoter Score and Customer Effort Score are very popular surveys typically conducted at the close of a customer service interaction. Questionnaire responses may be collected in a variety of ways:

Survey Venues

“Intercepts” are when potential respondents are approached in public areas about taking a survey. This is most effectively accomplished in a shopping area, at a convention, conference, or even door-to-door.

The prevalence of text message has opened up new opportunities for gathering survey data.

The internet provides the most efficient method of obtaining survey responses either through email, web, or pop-ups.

Postcard surveys are effective when a target audience is less comfortable with technology and return postage is included.

Specialized Surveys

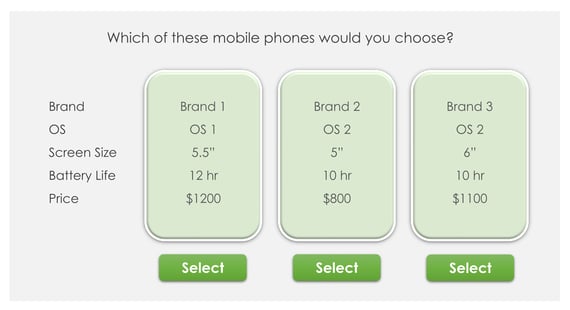

A conjoint survey describes a product or service in terms of given attributes. The levels (or values) of those attributes are varied across profiles (or sets) and the respondent is asked to rate a given profile, independently of the other profiles. Conjoint surveys are similar to MaxDiff, however, in conjoint surveys the rating or choice is based on the cumulative value of components. This method is useful in measuring price sensitivity and designing new products. See Conjoint Analysis & Discrete Choice Modeling analytical technique for more detail on analysis of these surveys.

Also known as “best-worst scaling,” MaxDiff surveys involve breaking down a subject into its component parts, then a short list of a few of those attributes is created and the respondent is asked to rank the value of those attributes. This process is repeated multiple times with varying combinations of the product attributes. This can be effective for testing a series of alternative messages or positioning statements, product features, or brand preferences.

Syndicated Research

Syndicated Research

At Silicon Valley Research Group we will often incorporate business intelligence and research from syndicated sources into our analysis. Though this data was not intended for the particular study at hand, the data can serve to back up study findings, provide deeper insights into trends, or bring context to unique opportunities within a market.

Usability Labs

![]() Usability labs involve putting a prototype or application in the hands of potential users in order to observe and gain feedback on how the design can be improved. Users are asked to complete tasks, typically while they are being observed by a researcher, in order to see where they encounter problems and experience confusion. This method can help uncover trends in initial user experience. Usability labs are commonly conducted in-person, however, this method can also be conducted online via video conference, particularly when studying software and/or device usability.

Usability labs involve putting a prototype or application in the hands of potential users in order to observe and gain feedback on how the design can be improved. Users are asked to complete tasks, typically while they are being observed by a researcher, in order to see where they encounter problems and experience confusion. This method can help uncover trends in initial user experience. Usability labs are commonly conducted in-person, however, this method can also be conducted online via video conference, particularly when studying software and/or device usability.

Analytical Techniques

Analytical Techniques

Conjoint Analysis & Discrete Choice Modeling

Discrete choice modeling utilizes conjoint and/or MaxDiff survey data to evaluate and predict consumer decisions across variable product options. Conjoint analysis evaluates how respondents rank different attributes of a product or service in order to estimate the value of each component in terms of its effect on customer decisions (see specialized surveys). Discrete choice models are used to explain or predict a choice from a given number of mutually exclusive (or ‘discrete’) alternatives.

JTBD & Customer Anthropology

![]() “Jobs to Be Done” (or JTBD) research takes a look at the problems customers have which cause them to use your product or service. Customer anthropology is a complimentary methodology which involves observing customers at work as a means of discovering unmet needs. This can help companies uncover more efficient solution to address customers’ problems and better meet their needs. This technique may involve surveys, IDIs, focus groups, usability labs, and/or ethnographic site visits.

“Jobs to Be Done” (or JTBD) research takes a look at the problems customers have which cause them to use your product or service. Customer anthropology is a complimentary methodology which involves observing customers at work as a means of discovering unmet needs. This can help companies uncover more efficient solution to address customers’ problems and better meet their needs. This technique may involve surveys, IDIs, focus groups, usability labs, and/or ethnographic site visits.

Market Modeling & Simulation

Market modeling and simulation evaluates the topography of a given market landscape using segmentation strategy and surveys of all critical business players such as customers, suppliers, partners, etc. This method is useful in evaluating market share and competitive position as well as identifying new opportunities.

Monte Carlo Simulations

![]()

Also known as “multiple probability simulation,” Monte Carlo simulations evaluate the possible outcomes of a decision and calculates the probability of each outcome occurring. This is a highly quantitative analytical technique is particularly useful for risk analysis in the decision-making process and has a significant success rate of predicting outcomes even when there is high uncertainty.

Multivariate Analysis

Multivariate analysis is a catch-all term for any statistical technique that simultaneously analyzes relationships among multiple variables. This is useful when it can be generally assumed that the subject is influenced or affected by more than one thing, such as how price sensitivity, brand perception, and user experience can be studied to better understand customer retention.

Regression analysis is a particular multivariate statistical technique used to determine if there is a strong or weak cause and effect relationship between two or more things.

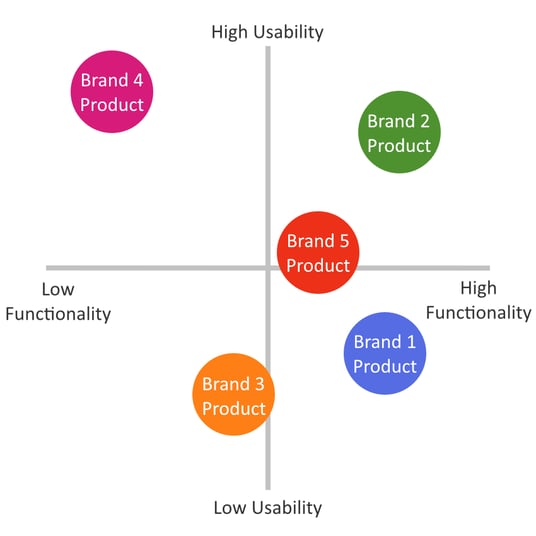

Perceptual Mapping

Also known as “multidimensional scaling” or by the acronym MAPP, which stands for Mathematical Analysis of Perception and Preference, perceptual mapping is the graphic representation of consumer perception in relation to a company, brand, or product. This technique is useful on its own or as a compliment to other analytical techniques such as discrete choice modeling. At Silicon Valley Research Group, we have found perceptual mapping to be particularly effective in aiding the communication and dissemination of research findings across an organization.

TURF Analysis

TURF stands for Total Unduplicated Reach and Frequency. This analytical technique evaluates survey data to find trends in preferences across combinations of variables and estimates the associated costs of each option. TURF analysis is useful for efforts such as finding the combination of products and services that will appeal to the greatest number of customers and maximizing marketing reach per unit of cost. It is also useful in determining market potential.

Win- Loss Analysis

This method examines how new, current, and lost customers respond to the way a company is marketing its products and services. Win loss analysis delves into the consumers perspective and their selection criteria. This can be measured in an absolute sense as well as in relation to competitors. Understanding consumer perspective is particularly helpful for organizations with long sales cycles and value-based pricing models. Win loss analysis frequently involves IDIs and surveys.