So an unusual discovery as I made my weekly online research rounds. A claim by easy...

The Inner Game of Market Research

You’ve heard of the inner game of tennis, the inner game of golf-why not the inner game of research? In sports, the inner game is about flow and mind/body cohesion. When players stop focusing on the mechanics and do what is natural and instinctive for them, their game improves significantly.

Is there an inner game to what is seemingly a very left brained, data driven field like market research? And can we improve our game by focusing on the inner game. Let’s find out.

The starting point would have to be defining the perfect game. What is a good game in market research? What does playing a winning game look like? Here are some ideas:

- When the data informs decisions. This may seem like an obvious statement, but too often, particularly in large organizations, the incoming data, while thought of as valuable, does not permeate through the organization well enough to effectuate the recommended change.

- When the data creates course correction. New incoming information about customer behaviors or dissatisfactions is acted upon in a timely manner. Many organizations are simply not structured to accept and act upon the change. The well-oiled machine needs to keep running and the workflow is simply not designed for interruption and course correction.

- When the data is incorporated into long business strategy. Incoming intelligence is mined for nuggets that impact long term strategy, parsed out and appropriately disseminated to those plotting long term strategy. The strategists in the organization are high ranking executives and their hired consultants and seldom do they venture deep down enough to access this data, let alone take it into account.

So what can researchers do to ensure that the market research data they generate maximizes return for the clients and stakeholders? What is the “inner game” that the researcher, either internal to the organization or an external supplier, need to play in order to win?

A while back, I wrote a white paper titled “The Customer Intelligent Enterprise”: in which I identify some of the barriers to research data informing enterprise strategy. The link at the end of this post will give you access to the white paper if you don’t have it yet. Here are some additional “inner game” principles for researchers:

- At the research design stage, determine all the possible stakeholders for the data based on the research agenda, survey, or discussion guide you are creating. Contact those stakeholders at the beginning of the process versus once the data is in. Set the expectation and build anticipation. Be mindful and respectful, of course, of your main stakeholder or research funder and get them on board as you do this.

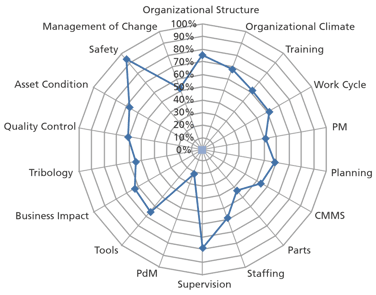

- Once the research survey instrument has been created, create a “spider diagram”epicting which groups a

nd teams are impacted or need to hear the findings. You will add to this diagram and tweak it as theproject progresses and data comes in, but at least you will have a plan for dissemination upfront.

nd teams are impacted or need to hear the findings. You will add to this diagram and tweak it as theproject progresses and data comes in, but at least you will have a plan for dissemination upfront. - Create a powerful storyboard for the report and presentation Very often, these stakeholders will not be researchers, so make sure your presentation tells a compelling story beyond just the data. Research presentations are often choke full of data slides, understandable as researchers feel that is what the client paid for, but think “Appendix” for this data. If possible, consider two presentations.

- Offer encore presentations for other groups within the organization once the initial presentation of the research project’s findings has been completed. If an external suppler is involved, incorporate this as part of the initial expectation asking any costs to be incorporated or negotiated upfront. Offer customized views of the data depending on the needs and orientation of the group you will be presenting to. This too should be set up with an external supplier upfront. At my firm, Silicon Valley Research Group, we have designed a one page document we call the One Minute Executive Brief. Designed to be read in under a minute, the brief can be circulated to non-research stakeholder within client organizations including higher level executives.

- Become a champion and evangelist for research within the organization. Too often, higher echelon executives view market research as a highly tactical tool to be used to solve specific problems such as designing the user interface. Researchers would serve the organization well by evangelizing the strategic value of the work that emerges from their seemingly tactical assignments. External suppliers need to be savvy on maximizing value from the research investment. Understand the “Power Base Selling” principles that are the core of how your client organization functions and work with your key stakeholder to expose the findings to the appropriate affected groups and divisions.

Follow this link for the white paper referred to above.

Alan Nazarelli is President & CEO of Silicon Valley Research Group, a global market research and strategy development firm focused on the needs of technology companies.